Daily Investor Update 28 April

Posted by JSCFinancial on Wednesday 28th of April 2021.

With the vaccine rollout continuing to progress and the gradual easing of lockdown restrictions, there appears to be some light at the end of the tunnel. With this in mind, we hope you and your close ones are staying safe.

The coronavirus pandemic has caused significant volatility in global equity markets and we continue to see larger daily falls and gains than we would normally expect. It is therefore really important that you think twice before taking any action over your pensions and investments.

The FTSE 100 index was down 0.3% yesterday (Tuesday 27 April 2021) as European equity markets considered the concerns about coronavirus in countries like India as well as the latest quarterly earnings updates in the United States.

Germany’s DAX 30 was also down 0.3% while France’s CAC 40 was just about level.

In the United States, the S&P 500 closed little changed near its record level as the major equity markets braced for a big batch of tech earnings. The Dow Jones 30 was also flat while the Nasdaq was 0.3% lower.

Shares of Tesla fell 4.5% even after the electric carmaker posted record net income of $438 million. Tesla also beat Wall Street’s earnings and revenue expectations handily, boosted by sales of bitcoin and regulatory credits. The shares have struggled this year, off by more than 20% from their record. The stock is still up more than 300% over the last 12 months. Other large tech companies such as Alphabet, Microsoft and AMD are also reporting this week.

Whatever you are invested in, we’d like to remind you about the following key principles.

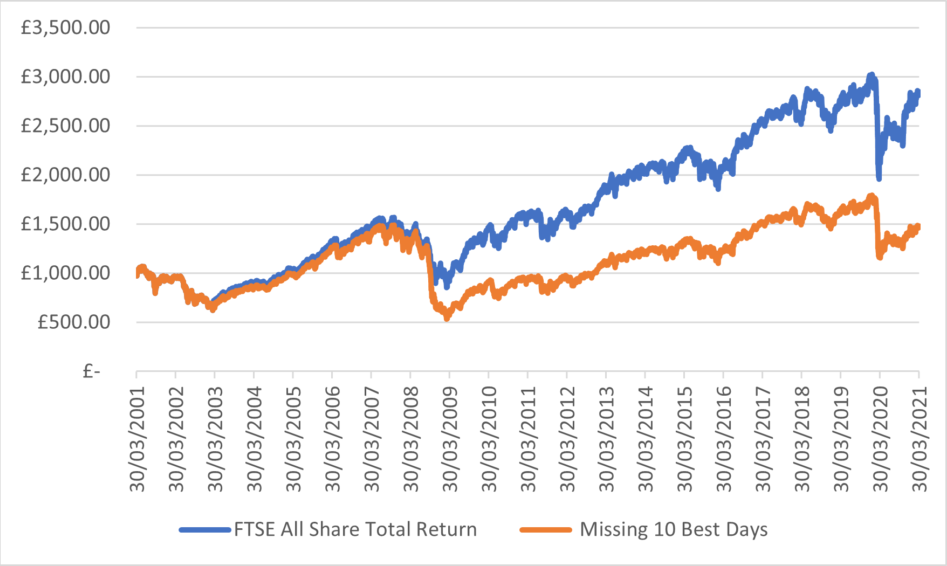

- Stay invested – as you have seen global equity markets fall and the value of your own investments fall as well, it is natural that some of you will be thinking whether you should sell your investments and move to cash or some other “safe haven”. Our strong message to you is stay invested, focus on the investment objective that you set with your Financial Adviser at outset and trust the process. History shows that as night follows day, global equity market recoveries follow global equity market falls and it is damaging to miss out on the recovery days. The following chart shows the performance of the FTSE All Share over the last 20 years, between 31 March 2001 and 31 March 2021, and the impact if you missed the 10 best days. The cost of missing these 10 best days would have been over 3% a year (Source: Omnis Investments).

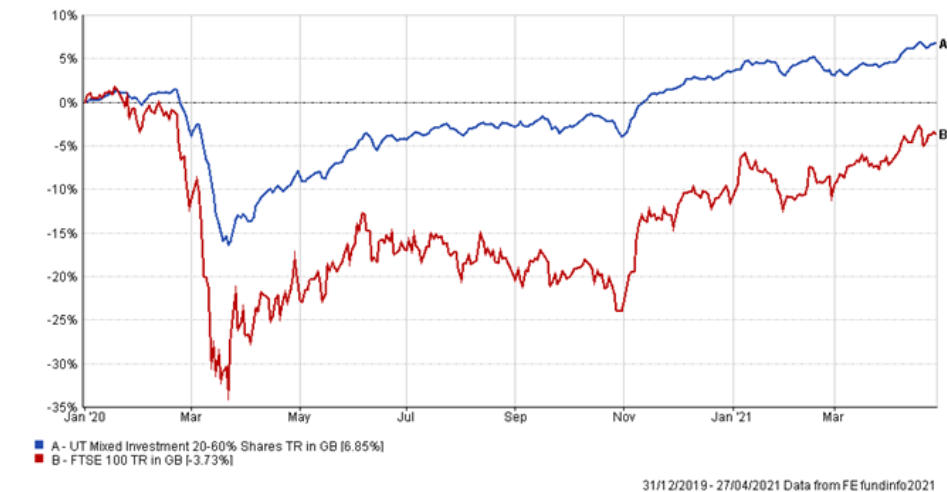

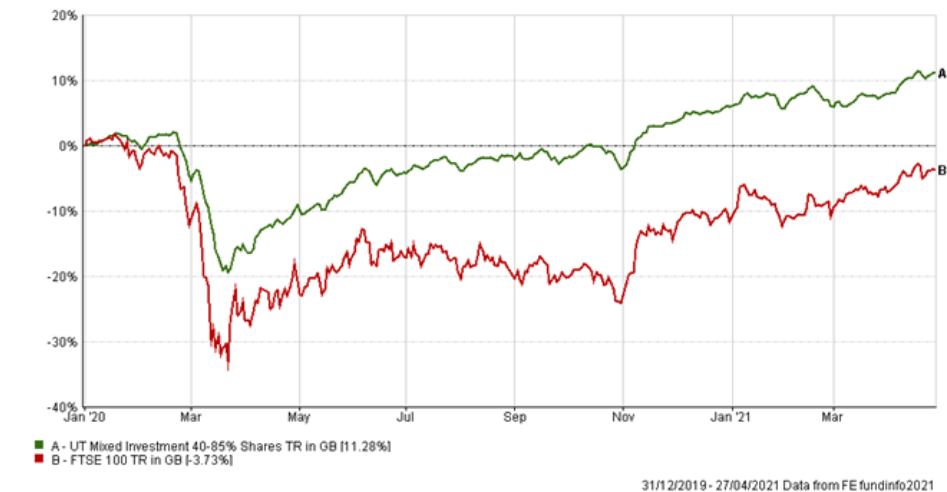

- Understand your attitude to risk – we know that you will have discussed your Attitude to Risk and your capacity for loss comprehensively with your Financial Adviser. We are delighted that this process appears to have really worked during this extremely short-term volatile period.

If you are a Cautious or Balanced investor, you have been protected from the extreme falls of global equity markets. In fact, if you look at the average of all Cautious funds in the market (using the IA sector – Mixed Investment 20% to 60% Shares), a typical Cautious investment will be up by almost 7% since the start of 2020, compared to the FTSE 100 which has fallen by between 3% and 4% (Source: FE Analytics as at close on 27 April 2021).

For Balanced (using the IA sector – Mixed Investment 40% to 85% Shares), a typical Balanced investment will be up by more than 11% since the start of 2020 (Source: FE Analytics as at close on 27 April 2021).

- Diversify your investments – if you are invested in Openwork recommended investments in line with your Attitude to Risk like the Openwork Graphene Model Portfolios, Openwork Portfolio of Funds and Prudential PruFunds, your investment is diversifed which means it invests in a wide range of different asset classes.

Different types of investment (asset classes) and regions of the world all perform differently. Diversifying your investment by spreading it across many different asset classes and regions of the world means that, when certain segments aren’t performing as well, others in your portfolio are likely to be doing better and so will help protect the value of your overall investment.

- Buying low – when you invest, you are always trying to buy low and sell high. For many, now may be a good time to consider increasing your investment. While trying to time a market bottom is difficult, history tells us that you do not have to wait long, if you invest slightly before the bottom, before your investment is back to its original value. As the chart below shows, investing 5% before the market bottom has, on average, added just 3 days to an investor's recovery period.

In such unprecedented times, it is important to know that your hard-earned pension savings and other investments are being looked after. The Openwork Investment Committee is monitoring your investment closely. While none of us can stop short-term market falls, we do fully expect global equity markets to recover. We cannot predict timescales but if you do not need your money now, we believe you will be rewarded for staying invested.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

Past performance is not a reliable indicator of future performance and should not be relied upon.

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.